Transocean ($RIG): Long Equity

Offshore Drilling's Lone Survivor Has Significant Asymmetric Upside

Executive Summary

Transocean Ltd. (“RIG”) is a highly-levered equity whose stock price is down ~75% since the most recent peak in 2018. “Smart money” has been wrong on offshore drilling for a decade. Energy pessimism hit an all-time high amid COVID and the OPEC/Saudi price war. The market bid up renewables and left fossil fuels for dead. It’s quite possible that Oilfield Services has destroyed more capital and created more investor pain than any other. Thus far, RIG has been able to weather the challenges. However, the company carries $7.3bn in debt and faces a problematic maturity wall in 2023. Revenue backlog is an industry leading $7.4bn, but continues to roll off faster than new contracts are being signed. Simply put, RIG is an over-levered business in a bad sector. FinTwit prefers optically great businesses in growing sectors. So why am I pitching this now?

Paul Enright, an investor I admire, said this:

I believe RIG is a great idea in a bad sector on the cusp of a major structural improvement. RIG has liquidity and runway to survive until the offshore drilling cycle turns, and management has plenty of levers to pull. RIG’s unsecured bonds trade at a discount to par, implying the company has no equity value and trades as a speculative option. While the structure is unsustainable at current dayrates, I believe the market is fundamentally mispricing RIG’s convexity into the recovery. I am LONG RIG equity - my math suggests in an environment where new contracts are struck at dayrates around 350kpd, the stock is worth at least 2x - 4x from where it trades today. If the offshore drilling cycle rips as I believe it could, $15 - $20 / sh is achievable.

Capitalization & Financial Overview

Transocean Ltd. (“RIG”) is an offshore drilling operator with a fleet of 39 mobile offshore drilling units, including 27 ultra-deepwater floaters (with 2 under construction) and 10 harsh environment floaters, with an average age of ~10 yrs. 11 vessels are 2015 vintage and earlier, while 18 can drill at 40,000 feet deep at 12,000 feet of water. RIG’s 2 newbuilds (which have yet to be delivered) will be the highest-spec assets in the world. RIG is highly levered with $7.3bn of debt, but has ample liquidity, consisting of $1.0bn of unrestricted cash, $388mm of restricted cash for debt service, and a fully undrawn $1.3bn RCF (excluding $21mm of LCs). 22 of RIG’s vessels are actively contracted today, and on a CFO - CapEx basis the company is cash flow positive. So what’s the problem here?

Vessels Rolling Off Contract = Cash Burn = Maturity Wall Issue

Transocean has maturity walls of $200mm by 2022, $530mm by 2023, and $1.3bn by 2024. The 2023 maturity wall is problematic given the majority of RIG’s fleet will be rolling off contract towards the end of 2022. Despite the company’s $7.4bn backlog, RIG needs to sign new work or execute incremental debt exchanges to overcome this hurdle. In Q121, RIG announced 2 new small contracts as well as 3 customer-exercised options to continue work. Both the backlog and my financial projections assume no speculative contract reactivations, so absent a major commodity price correction there is considerable upside to all these figures. The key takeaway is RIG’s liquidity. Even assuming the full $1.3bn of newbuild CapEx is spent in 2021, RIG doesn’t run out of money. The debt markets have been open for business to RIG, and as long as that continues, I expect the company to continue to push its debt out and to the right. Excluding its successful multi-billion tender offers, RIG has repurchased more than $100mm of debt on the open market at discounts to par. RIG’s capital structure is a long-term problem, but not a near-term one. With just a little help from the market, RIG can grow into it.

Why Transocean?

I think Transocean has the best active assets and management team in offshore drilling, with contracted cash flow (bolstered by strong customer relationships) and liquidity (cash & RC capacity) to survive until the cycle turns.

Contracted cash flow is a key differentiator for RIG. Unlike RIG’s competitors ($VAL, $NE, $DO, $SDR) which were driven into bankruptcy, Transocean’s active contracts were not terminated in Q1 & Q2 2020. Management disclosed on their Q120 Earnings Call this was due to stronger contractual terms and conditions versus the weaker language of its competitors. Per CEO Jeremy Thigpen:

“These contracts were strong, not just from a dayrate perspective, but the quality of the customers and the strength of the terms and conditions in the contracts…Essentially, force majeure situations are not upon us.”

RIG management was laser focused on making sure RIG’s customers could not dissolve or otherwise exit the contracts without some form of penalty compensation.

“That may be upon the customers at which they decide they wish to terminate. But in all the cases of the contracts we have, there's certainly remedy periods and time to overcome those particular instances. Or if they wish to terminate quickly, then there's a pretty sizable payout attached with those contracts…we may be a little bit difficult on the terms and conditions, but we do that to protect ourselves from dramatic swings in activity.”

While management’s prudence to protect their downside on a contractual basis is critical to my underwriting, I believe this is a function of market conditions when these contracts were originally struck. Back in late 2014 / early 2015, drilling operators had negotiating leverage over their E&P customers given the strong commodity price environment as well as significant demand for a limited supply of capable drilling assets. A wave of speculative newbuilds into an early 2016 oil price selloff inverted this relationship for the next 5 years.

Transocean has ample liquidity, which stems back to management’s prioritization of a defensive strategy when they survived the first wave of oilfield services distress during the late 2015 / early 2016 oil crunch. While other offshore drillers focused on fleet expansion and acquiring scale in anticipation of a cyclical peak, Transocean took a different approach. RIG’s management decided to upgrade and rightsize their assets, pruning the fleet and evolving into the largest operator of the highest-quality assets in the ultra-deepwater and harsh environment space. Transocean proactively scrapped older vessels while opportunistically acquiring or building more efficient ones. Note that in September 2018, RIG acquired OceanRig’s vessels, taking ownership of 15 of the top 50 UDW semisubmersibles, and 26 of the top 100 semis worldwide, nearly double its next-best positioned competitor. Additionally, management executed several billion dollars of liability management over the years in an effort to repair the balance sheet. While other drilling operators were focused on offense, positioning themselves for what they believed was an imminent market cycle, Transocean was the only operator playing defense. I believe management’s conservatism and patience has provided them an opportunity to not only survive the cycle, but take significant market share.

Signs of an Improving Market

After a decade of false starts, anti-competitive behavior, and a massive oversupply of vessels relative to the availability of new contracted work, I believe the offshore drilling industry is finally in a sustained period of tightening. Without getting too deep into the industry’s painful history, the explosion of U.S. shale combined with a wave of speculative drillship newbuild created a massive supply glut. Drillships are expensive to build and consume significant amounts of cash when they are off contract. Financing all this required offshore drillers (formerly IG-rated businesses) to lever up. The oversupply of cash burning vessels combined with elevated debt service requirements fueled a ‘race to the bottom’ on pricing as operators signed low-margin work just to keep the dream alive. Pre-COVID, utilization of drillships was approaching 85%, but dayrates were still low. Several offshore operators with uncontracted, cash-burning drillships (most notably, Valaris) were focused on maximizing utilization as opposed to cash flow. Maximizing utilization was a bandaid strategy designed to artificially force dayrates higher. It nearly worked. In early 2020 the market was beginning to see greenshoots, before COVID-19 and the OPEC/Russia price war crushed the entire sector. The silver lining of the past 12 months is the oil market has undergone the most dramatic rebalancing in decades. Offshore drilling will recover, and RIG will be the ultimate beneficiary. Here’s why:

Consolidation of Assets.

A wave of offshore drilling bankruptcies has tightened the market considerably. Diamond Offshore (April 2020), Noble Corp (Aug 2020), Valaris (Aug 2020), Pacific Drilling (Nov 2020), Seadrill (Feb 2021)

March 2021: Diamond Offshore and Seadrill Partners enter into agreement under which Diamond Offshore would provide operational management and marketing services to three of Seadrill Partners’ rigs

April 2021: Noble Corp and Pacific Drilling closed an all-stock merger

May 2021: Noble Corp submits unsolicited bid to acquire '“substantial portion” of Seadrill Ltd.’s assets

Bottom Line: Consolidation creates a tighter market, with less assets being bid for a limited number of contracts, and encourages more rational behavior.

Rig Supply is Finally Tightening.

It’s becoming increasingly clear that offshore vessels built before 2014 are not going to earn a contract. Pro forma for the acquisition of Pacific Drilling, Noble claimed it would operate a fleet of 24 rigs. However, in the company’s Q121 press release, Noble announced that two of these 24 rigs, the Meltem and the Scirocco (built in 2014 and 2011, respectively) would be cold-stacked. Valaris’ post-reorg plan wiped ~$7bn of debt from its capital structure, scrapped 16 rigs and cold-stacked 15 rigs over the course of 2020. While these retirements are years overdue, this behavior is a signal that the dog days are over. And there’s more scrapping to come. Borrowing from RIG’s management, “scrapping or retiring [outdated, cash burning rigs] is the name of the game.” Per RIG’s Q420 Earnings Call:

…[T]he announcements made by several of our competitors that they intend to scrap a lot of these assets because during the restructuring, they basically have removed the financial shackles on taking those steps, plus some consolidation, I think it's very easy to see significantly fewer number of rigs available and hands a fewer competitors…And now we see like quarter on quarter, the number of cold-stacked rigs is going down because the equivalent number are actually being scrapped. And if we look at scrapping in general…by our count, we're about 160 rigs have been scrapped since the beginning of the downturn in 2014. And if you count the numbers…it's approaching half of the fleet…[a]nd we think it will actually eclipse half the fleet at some point later this year.” (emphasis added)

Bottom Line: Cold-stacked rigs are not economical to return to service, and customers don’t want them anyway. The “real” marketable drillship fleet is much smaller than the market believes.

U.S. Shale is Dead

The Financial Times asked the question “Can a leaner industry ever lure back investors?” The answer is: no, it cannot. Shale was a significant play for oil supermajors (ExxonMobil, Chevron, Shell, Total) when these companies were spending on smaller short-cycle projects. The supermajors were spending on shale because they were cash-strapped in a ~$35 / bbl oil world, and prioritizing propping up their share prices with debt-financed equity dividends instead of making any significant reinvestment in their businesses. The shale boom and the activity within the Permian Basin turned the U.S. into a net exporter of oil, but created an oversupplied oil market. As oil crated to negative $37 / bbl, short-cycle projects which created this supply glut suffered. The FT frames the problems shale faces going forward:

“After years of growth, shale’s cash-intensive business model was running on fumes even before Saudi Arabia’s price war with Russia and the coronavirus pandemic crashed the oil market last year. The sector’s defining feature is the fast decline of each shale well’s production, where output can drop by 80 per cent after just a year. To offset the loss, another must be drilled. Then another, to offset that well’s loss.”

Shale is simply uneconomic.

“The fundamental problem with the shale model over the past decade has been the pursuit of growth over return on capital employed or returning capital to shareholders,” says Ben Dell, managing partner at Kimmeridge, a private equity firm that has built up an activist position in the sector.”

It’s clear the supermajors have shifted their capital allocation priorities. ExxonMobil and Chevron have slowed down production and capital spend in the Permian, focusing instead on debt reduction and cash flow generation. According to energy data provider Enverus, cited by Energy Intelligence, Exxon’s rig count in the Permian has declined by 85% over the past year. Exxon currently has seven operating rigs in the region, down from a peak of 46 rigs. Chevron’s CFO Pierre Breber is forecasting a 5% decline in the company’s 2021 Permian production.

So what’s an economic way for an oil major to drill and replenish reserves? Offshore.

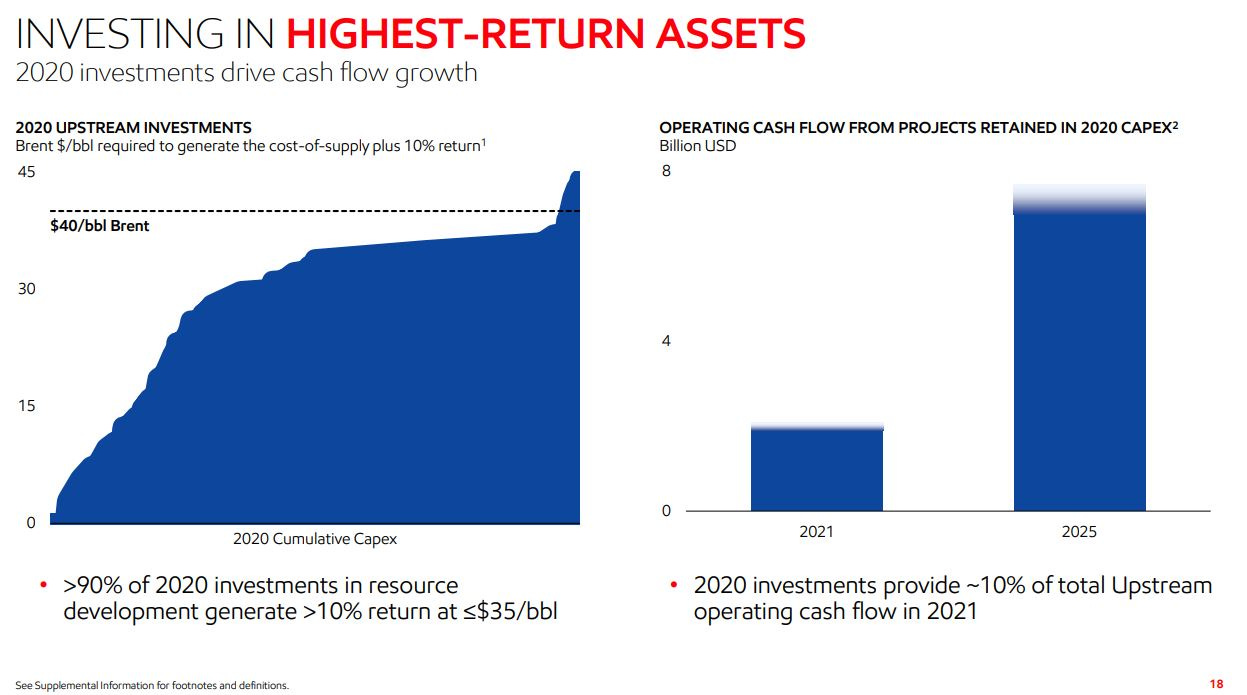

Since late 2015 / early 2016, there has been effectively zero investment by the supermajor E&Ps in the 100k - 700k bbl/d projects that move the needle (i.e. Exxon / Guyana). These projects require billions of upfront capital to ramp, but once they are running, they produce 80 -100k bbl / d for the next 20 - 30yrs at much better economics than shale. Importantly, these projects can only be drilled by offshore operators such as Transocean. While the supermajors were hesitant to spend growth capex during periods of peak shale production for long-cycle offshore projects, offshore now is looking more like maintenance capex, essential for replenishing reserves for the next 10 - 20 years. Exxon explicitly states this in their Q121 Earnings Presentation:

Deepwater investments represent Exxon’s highest return opportunities…

…Representing 90% of Exxon’s 2020 investments. Going forward, Offshore is Exxon’s focus.

Bottom line: Investment into offshore drilling is the priority of supermajors going forward - not shale.

The Future is Green - But Not For Decades

I’ll keep this one short: even in the most unrealistic upside case, renewables cannot replace the need for fossil fuels for several decades. But for a cyclical energy equity like Transocean, we aren’t required to take a view on whether or not the energy transition is real. This trade works in 8 - 12 months, not 5 - 10 years.

Catalyst: Higher Oil & New Contracts

Offshore drilling operators and their supermajor E&P customers play a delicate game of ‘cat and mouse’. In order to drill their multi-billion dollar deposits, E&P customers need to hire a limited number of expensive, technologically-advanced drillships and their highly trained crews, at the cheapest rate possible. Bringing a drillship out of storage requires the operator to spend a significant amount of reactivation costs ($20 - $30mm for warm-stacked rigs, and $50mm or more for cold-stacked rigs). Further, these drillships need to be constantly repaired and maintained, as well as in compliance with various industry and maritime regulations. The operator is largely responsible for fronting all of this expense. As a result, the offshore operator is only incentivized to accept new work if the drillship can earn a suitable return on the dollars the operator will spend to reactivate it. Right now, the bid / ask between drillship operators and their customers is still too wide, but is narrowing as operators are prioritize short-term work for long-term optionality.

Dayrates today (which vary depending on the type of work, term, and geography) are roughly in the 215k – 250kpd range. I believe a suitable dayrate marking the beginning of a cycle of new contracting will be ~300kpd and higher. While the exact timing of when dayrates will inflect is difficult to call, drillship utilization is a key indicator to watch. Evercore ISI data indicates the utilization of drillships is back to pre-COVID levels. RIG management believes Gulf of Mexico drillship availability will be “sold out” by 2022, and stated on the Q420 Earnings Call that mid- to high-200kpd dayrates was “very possible in the next 12 - 18 months.” Once the supermajors realize their ability to contract from a limited number of drillships is closing quickly, they pivot from price setters to price takers. Dayrates are forced higher, and the cyclical trade is on as the market re-rates RIG’s entire structure.

Illustrative Value Creation

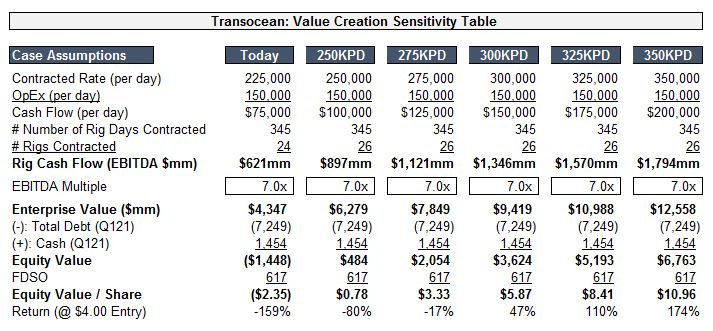

Here’s how I think about the return potential in RIG equity.

The table sensitizes a range of scenarios based on slight changes in contracted dayrates (kpd), as well as assuming RIG’s two newbuilds get contracted at the market rate - conservative given the high-spec nature of these rigs. On today’s dayrates, RIG equity has zero value. But the table illustrates how levered RIG is to small changes in dayrates relative to historical peaks of $400 - $450kpd. You don’t need to believe too much to see how this stock starts to get very exciting as the market improves.

Risks & Mitigants

While oil prices remain the wild card, I view the ultimate fundamental bear thesis to RIG as follows:

RIG’s bankrupt competitors have emerged in a much better financial condition to weather an extended cycle, which hurts RIG’s competitive positioning

Offshore drilling operators are doomed to repeat the sins of the past and will continue to engage in anti-competitive behavior

Addressing the first bear argument, after destroying billions of shareholder and lender capital, RIG’s competitors certainly have better cap structures post-emergence. But none of RIG’s competitors have zero debt, and the largest ones are plagued with a majority of aging, sub-par assets that operators don’t want. Years of limited new work, significant cash burn and an over-supply of rigs made it difficult for RIG’s competitors to adequately maintain their fleets. The repercussions of not making these re-investments and performing sloppy work opens the door to business risk (see Valaris’ missteps here and here). Operators who make drilling mistakes while managing multi-billion dollar deposits lose the trust of their customers. RIG’s conservative focus on high-grading its fleet and executing to perfection creates a virtuous feedback loop: Better Performance = Happy Customers = Repeat Business. Per RIG’s Q220 Earnings Call:

“…we're very happy to report that our operations team have absolutely nailed it…the customers that are getting a taste of Transocean for the first time are seeing that we really are delivering value…the well times are tumbling and, of course, the return on investment for the operators is looking better and better…And…with our long-term customers, we're executing extremely well, as can be seen in the revenue efficiency numbers…we really believe that there's a lot of value in that. We have some of our customers telling us we know that you guys are a bit more expensive. You perhaps deserve that premium. They're almost cautioning us not to be too expensive…But we're proud to say that we're able to get a premium, but I think we delivered tremendous value for that premium. And actually, I wouldn't describe it as a premium, I would describe as saving for the operators.” (emphasis added)

RIG’s management team believes the mass bankruptcy of their competitors has only improved their competitive position. Per the Q420 Earnings Call:

Connor Lynagh -- Morgan Stanley -- Analyst

“Are you concerned about your competitive position as competitors reemerge with clean balance sheets? On one hand, it would argue for them having a lower cost structure. On the other hand, bids at sub $200,000 a day suggests interest expense and return on capital weren't really major factors in bidding behavior. So where do you think that shakes out?

Jeremy Thigpen -- President and Chief Executive Officer

“…all I can do is look back at what we've seen recently and kind of walk through that and assume that that will replicate itself as we go through the second wave. If you think back to the first wave [2016], you had companies like Pacific and the Seadrill and Ocean Rig and Vantage go through restructuring. Out of all four of those, only Ocean Rig came out with a clean balance sheet. The rest…I think they're still going to have quite a bit of debt…It will be pushed to the right and certainly be reduced from what it is today. And I doubt that they're going to come out with a lot of cash. And as you well know, it takes a lot of cash to operate and maintain these assets and certainly a lot of cash to reactivate them. So I'm not sure that they're going to be in a much better position than we are, first of all.

…The other thing we saw was when these companies were going through the restructuring process, we increased our market share. And I can't tell you it was because our customers were definitely choosing the more financially stable, less distracted organization, but it sure showed up in the way that we won contracts because we were not below better during that time. (emphasis added)

Addressing the second bear argument perspective, anti-competitive behavior was the inevitable result of too many operators with too many assets competing in a shrinking market. Bankruptcy, consolidation, and a wave of scrapping has done more to alter this behavior than the market currently believes. RIG management has addressed this topic several times on its earnings calls. Per RIG’s Q121 Earnings Call:

Ian MacPherson -- Simmons Energy -- Analyst

…today, you have the recovery market with competitive landscape coming out of distress. And that had been in a lot of people's minds, a bearish angle for Transocean (given) [t]he cleansing of your competitors' balance sheets, but…you didn't point to any disruptive pricing tactics by your competitors. So do you feel as sanguine about competitive price discipline now given the change in your landscape as you did 15 or 18 months ago?

Jeremy Thigpen -- President and Chief Executive Officer

Yes…I think that we're going to see drastically different behavior from our competitors post restructuring. They now have new ownership, new governance on their boards. And our strategy has been to maximize cash flow from our drilling contracts. I think maybe strategy from some of our competitors was to increase and maximize utilization. I think that this approach is going to change under this new leadership. I mean, you saw how quickly Pacific and Noble came together post emerging from restructuring…by consolidating businesses to eliminate Board costs and executive management team costs, [and] to expedite the retirement of assets to avoid the stacking costs and future reactivation costs. So we think there's going to be a far more disciplined approach to generating cash flow from competitors.

Certainly, with the elimination of their debt, we acknowledge that [RIG’s competitors are] not going to have the interest expense that we carry. And so fundamentally, they will have a lower cost structure, which they could leverage, but they also emerged from restructuring without a whole lot of cash…Pacific emerged from restructuring with $100 million in cash and within four months when they merged with Noble, it was down to $30 million. These businesses consume just a lot of cash.

And when you have backlog that's not generating much cash because the day rates are so low, they can burn through it quickly. And so we think the focus from our competitors is like us going to be on maximizing of cash flow from these drilling contracts…

Roddie Mackenzie -- Senior Vice President of Marketing, Innovation, and Industry Relations

…I would just add that disruptive bidding practices are just not required because the market we have supports something much, much better. And everybody is looking at the same data as we are. So we think there's going to be a significant shift, for sure. (emphasis added)

Futher Levers to Upside

Some other catalysts I believe could drive RIG equity higher include the following:

Incremental Secured Debt Issuance & Exchange Transactions

Potential to Delay Delivery & Defer CapEx on newbuild assets

Higher Oil Prices through Reopening, further OPEC supply cuts, or incremental environmental restrictions led by Biden Administration

New Drillship Contracting

Summary: LONG Transocean Ltd. Equity ($RIG) at $4.00 with 2x - 5x Upside

I’m LONG Transocean Ltd. equity ($RIG), a levered call option on what I believe are telegraphed signs of an industry in major structural repair. Despite RIG’s considerable debt stack, RIG has liquidity and runway to survive until the offshore drilling cycle turns, with incremental levers for management to pull (new secured debt issuance, potential newbuild capex deferrals etc.) Offshore Drilling is a trade that the “smart money” has gotten wrong for a decade - a real hedge fund widowmaker. The catalyst to value has been a series of head fakes, the biggest one coming directly before COVID hit. But drillship utilization has recovered to pre-COVID levels, and the industry is in a much more sustainable position. The setup of i) consolidating players, ii) capacity rationaliztion, iii) a reset in anti-competitive behavior, and iv) renewed supermajor investment in offshore is a setup that gets me excited. Trading prices on RIG’s unsecured debt indicate the credit markets believe the equity is a zero, but with ~1.5 yrs of liquidity runway, I’m willing to take that bet.

01AUG2022. Contract extended for $440k/day (2 years)

02AUG2022. Contract extended for $430k/day (5.8 years)

I would say it is time to revisit. They are still losing money, but still selling for roughly the same price...

You should write an update to this piece. In many ways the thesis is playing out although the price has really not cooperated.